Gensler, 'Necessary Evil' For Intentional Crypto Bear Market

블록스트리트 등록 2022-12-13 17:27 수정 2022-12-13 17:28

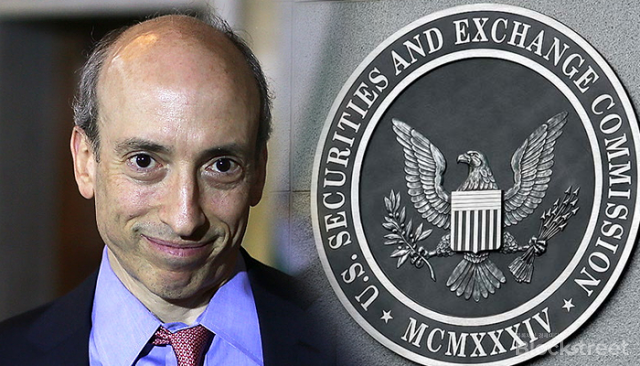

U.S. Securities and Exchange Commission Chairman Gary Gensler's stubborn persistency on crypto market was a inentional production.

# Gansler and His Doubtful Suspicions

Recently, a collusion between Gary Gensler and FTX's former CEO Sam Bankman-Fried became an issue , leaving the market in great confusion.

Many people reported that Gensler was Sam Bankman-Fried's helper, especially helping Sam Bankman-Fried establish a securities trading platform IEX.

On November 15, amid the collapse of the FTX and a major disruption in the crypto market, John E Deaton, a lawyer representing the XRP community, filed a petition accusing Gensler on charges of a collusion between Gensler and Sam Bankman-Fried and their market monopoly.

It was claimed that Gensler met Sam Bankman-Fried just before the FTX collapse and was providing a regulatory 'free pass' to Sam Bankman-Fried.

U.S. Republican Congressman tom emmer also pointed out Gensler's corruption.

"I've got a tip in my office that Gensler taught someone how to avoid loopholes in the law and acquire regulatory monopolies," he said, raising suspicions that Sam Bankman-Fried launched a business linked to the securities trading platform IEX in March with the help of Gensler.

Based on a number of these suspicions, the collusion between Gensler and Sam Bankman-Fried began to be highlighted. In particular, media reports suggesting the collusion between the them have been re-examined.

What was revealed through the media is that in March, Gensler, Sam Bankman-Fried, and a number of cryptocurrency insiders held a video conference and discussed the establishment of a new cryptocurrency exchange approved by the SEC.

In this regard, the market interpreted that Sam Bankman-Fried planned to establish a platform that can trade both securities and cryptocurrency by combining securities trading platforms IEX and FTX, and sought the help of Gensler in the process.

The suspicion that Gensler colluded with Sam Bankman-Fried, U.S. Democratic Congressman Rich Torres called for an independent investigation into Gensler, citing that he did not take sufficient regulatory measures before the FTX bankruptcy. Torres insisted as SEC demanded the authority as a regulatory agency for cryptocurrency, SEC should be held accountable for the disruption in the crypto market by FTX bankruptcy.

# Gensler, Was It You?

It came as a shock to many that Gensler had colluded with Sam Bankman-Fried, who had been involved in several dubious incidents since the collapse of the FTX.

In particular, SEC Chairman Gensler was a person who has kept a stubborn and strict stance for cryptocurrency industry.

In 2020, SEC started a lawsuit against Ripple for violating the Securities Act, claiming that XRP, the third-largest cryptocurrency in the market capitalization at the time, is a security.

After stubbornly refusing to approve the Bitcoin spot ETF, Gensler has been criticized by the cryptocurrency community and ETF applicants, and has finally entered a lawsuit with large cryptocurrency operator Grayscale this year.

This year, Gensler used his authourity to regulate cryptocurrency market strictly and demonstrated his presence.

Under the claim that "all cryptocurrencies except Bitcoin(BTC) are securities," Gensler announced the punishment targeting for large cryptocurrency exchanges and DeFi platforms.

In particular, in September, he attacked Coinbase, the largest U.S. exchange, and punished some of the registered cryptocurrencies in the exchange by considering them as unregistered securities.

It was revealed that he, who had been so strict in the cryptocurrency market, cooperated beyond silence to Sam Bankman-Fried who had been more active in the cryptocurrency market than anyone else.

Many explain the collusion between Gensler and Sam Bankman-Fried had close relationship since MIT. In fact, Gensler and Sam Bankman-Fried were professors and students at MIT, respectively.

However, Gensler's incomprehensible behavior clearly existed before the collustion with Sam Bankman-Fried

# Blocking, Punishing, Pretending To Be Don't Know

A case that should look back in point is the relationship between Gensler and Terraform Labs, the main culprit of the "Luna crisis."

Last year, Gensler showed signs of a war with Terraform Labs. In 2021, he issued a summons without notice after warning that mirror protocols and synthetic assets led by Terraform Labs appear to be securities.

As a result, SEC and Terraform Labs announced that they would enter a lawsuit, but the conflict between the two sides suddenly subsided. The lawsuit disappeared as if nothing had happened.

Since then, Terraform Labs has announced in March this year that it would collect about $9.1 billion in Bitcoin and issue an algorithm stablecoin called TerraUSD(UST). The Bitcoin standard system, which issues dollars as reserved by bitcoin, emerged.

The SEC, which always looked at the cryptocurrency market with strict regulations amid the world's uproar over the emergence of the Bitcoin standard system, remained silent. Despite attracting many investors by collecting Bitcoin with more than $9.1 billion and issuing UST based on it, SEC remained silent.

The SEC simply remained silent until Terraform Labs' UST collapsed after failing to link the price with the dollar.

This silence was actually a message of agreement from the SEC's Gensler to Terraform Labs.

# Intentional Crypto Bear Market, Many Changes Resulting From It…'Necessary Evil' Gensler

It can be interpreted that Chairman Gensler was involved in both the 'Luna incident' and 'FTX incident', which were the main causes of the cryptocurrency market collapse this year, and that he actually stood by.

Based on this, a move was made to investigate independence along with a complaint against Chairman Gensler.

In 2022, Gensler appeared to block all major events that could create a rebound in the cryptocurrency market in addition to the two mentioned events.

His presence in the cryptocurrency market was enormous, including his refusal to approve Bitcoin spot ETFs, dragging the lawsuit with Ripple longer, and threatening large exchanges to create a panic in cryptocurrency market.

For whatever reason, Gensler led the bearish market in the cryptocurrency market this year with clear intentions.

Due to his faithful role, many changes are expected in the cryptocurrency market in the future.

On the positive side, the rapid introduction of clear regulations following the market collapse, the resulting industrial growth, and the individual favorable factors of the cryptocurrency market that Gensler had blocked will be happened.

His bearish production was intentional. As a result, the market has faced many changes and the changes will complete what someone wants.

As it was an intentional decline, it is expected to show a different pattern than before.

권승원 기자 ksw@

# Gansler and His Doubtful Suspicions

Recently, a collusion between Gary Gensler and FTX's former CEO Sam Bankman-Fried became an issue , leaving the market in great confusion.

Many people reported that Gensler was Sam Bankman-Fried's helper, especially helping Sam Bankman-Fried establish a securities trading platform IEX.

On November 15, amid the collapse of the FTX and a major disruption in the crypto market, John E Deaton, a lawyer representing the XRP community, filed a petition accusing Gensler on charges of a collusion between Gensler and Sam Bankman-Fried and their market monopoly.

It was claimed that Gensler met Sam Bankman-Fried just before the FTX collapse and was providing a regulatory 'free pass' to Sam Bankman-Fried.

U.S. Republican Congressman tom emmer also pointed out Gensler's corruption.

"I've got a tip in my office that Gensler taught someone how to avoid loopholes in the law and acquire regulatory monopolies," he said, raising suspicions that Sam Bankman-Fried launched a business linked to the securities trading platform IEX in March with the help of Gensler.

Based on a number of these suspicions, the collusion between Gensler and Sam Bankman-Fried began to be highlighted. In particular, media reports suggesting the collusion between the them have been re-examined.

What was revealed through the media is that in March, Gensler, Sam Bankman-Fried, and a number of cryptocurrency insiders held a video conference and discussed the establishment of a new cryptocurrency exchange approved by the SEC.

In this regard, the market interpreted that Sam Bankman-Fried planned to establish a platform that can trade both securities and cryptocurrency by combining securities trading platforms IEX and FTX, and sought the help of Gensler in the process.

The suspicion that Gensler colluded with Sam Bankman-Fried, U.S. Democratic Congressman Rich Torres called for an independent investigation into Gensler, citing that he did not take sufficient regulatory measures before the FTX bankruptcy. Torres insisted as SEC demanded the authority as a regulatory agency for cryptocurrency, SEC should be held accountable for the disruption in the crypto market by FTX bankruptcy.

# Gensler, Was It You?

It came as a shock to many that Gensler had colluded with Sam Bankman-Fried, who had been involved in several dubious incidents since the collapse of the FTX.

In particular, SEC Chairman Gensler was a person who has kept a stubborn and strict stance for cryptocurrency industry.

In 2020, SEC started a lawsuit against Ripple for violating the Securities Act, claiming that XRP, the third-largest cryptocurrency in the market capitalization at the time, is a security.

After stubbornly refusing to approve the Bitcoin spot ETF, Gensler has been criticized by the cryptocurrency community and ETF applicants, and has finally entered a lawsuit with large cryptocurrency operator Grayscale this year.

This year, Gensler used his authourity to regulate cryptocurrency market strictly and demonstrated his presence.

Under the claim that "all cryptocurrencies except Bitcoin(BTC) are securities," Gensler announced the punishment targeting for large cryptocurrency exchanges and DeFi platforms.

In particular, in September, he attacked Coinbase, the largest U.S. exchange, and punished some of the registered cryptocurrencies in the exchange by considering them as unregistered securities.

It was revealed that he, who had been so strict in the cryptocurrency market, cooperated beyond silence to Sam Bankman-Fried who had been more active in the cryptocurrency market than anyone else.

Many explain the collusion between Gensler and Sam Bankman-Fried had close relationship since MIT. In fact, Gensler and Sam Bankman-Fried were professors and students at MIT, respectively.

However, Gensler's incomprehensible behavior clearly existed before the collustion with Sam Bankman-Fried

# Blocking, Punishing, Pretending To Be Don't Know

A case that should look back in point is the relationship between Gensler and Terraform Labs, the main culprit of the "Luna crisis."

Last year, Gensler showed signs of a war with Terraform Labs. In 2021, he issued a summons without notice after warning that mirror protocols and synthetic assets led by Terraform Labs appear to be securities.

As a result, SEC and Terraform Labs announced that they would enter a lawsuit, but the conflict between the two sides suddenly subsided. The lawsuit disappeared as if nothing had happened.

Since then, Terraform Labs has announced in March this year that it would collect about $9.1 billion in Bitcoin and issue an algorithm stablecoin called TerraUSD(UST). The Bitcoin standard system, which issues dollars as reserved by bitcoin, emerged.

The SEC, which always looked at the cryptocurrency market with strict regulations amid the world's uproar over the emergence of the Bitcoin standard system, remained silent. Despite attracting many investors by collecting Bitcoin with more than $9.1 billion and issuing UST based on it, SEC remained silent.

The SEC simply remained silent until Terraform Labs' UST collapsed after failing to link the price with the dollar.

This silence was actually a message of agreement from the SEC's Gensler to Terraform Labs.

# Intentional Crypto Bear Market, Many Changes Resulting From It…'Necessary Evil' Gensler

It can be interpreted that Chairman Gensler was involved in both the 'Luna incident' and 'FTX incident', which were the main causes of the cryptocurrency market collapse this year, and that he actually stood by.

Based on this, a move was made to investigate independence along with a complaint against Chairman Gensler.

In 2022, Gensler appeared to block all major events that could create a rebound in the cryptocurrency market in addition to the two mentioned events.

His presence in the cryptocurrency market was enormous, including his refusal to approve Bitcoin spot ETFs, dragging the lawsuit with Ripple longer, and threatening large exchanges to create a panic in cryptocurrency market.

For whatever reason, Gensler led the bearish market in the cryptocurrency market this year with clear intentions.

Due to his faithful role, many changes are expected in the cryptocurrency market in the future.

On the positive side, the rapid introduction of clear regulations following the market collapse, the resulting industrial growth, and the individual favorable factors of the cryptocurrency market that Gensler had blocked will be happened.

His bearish production was intentional. As a result, the market has faced many changes and the changes will complete what someone wants.

As it was an intentional decline, it is expected to show a different pattern than before.

권승원 기자 ksw@